Condo Insurance in and around Liberty

Unlock great condo insurance in Liberty

Cover your home, wisely

- Liberty

- Dayton

- Hull

- Daisetta

- Hardin

- Crosby

- Mont Belvieu

- Baytown

- Winnie

- Houston

Home Is Where Your Heart Is

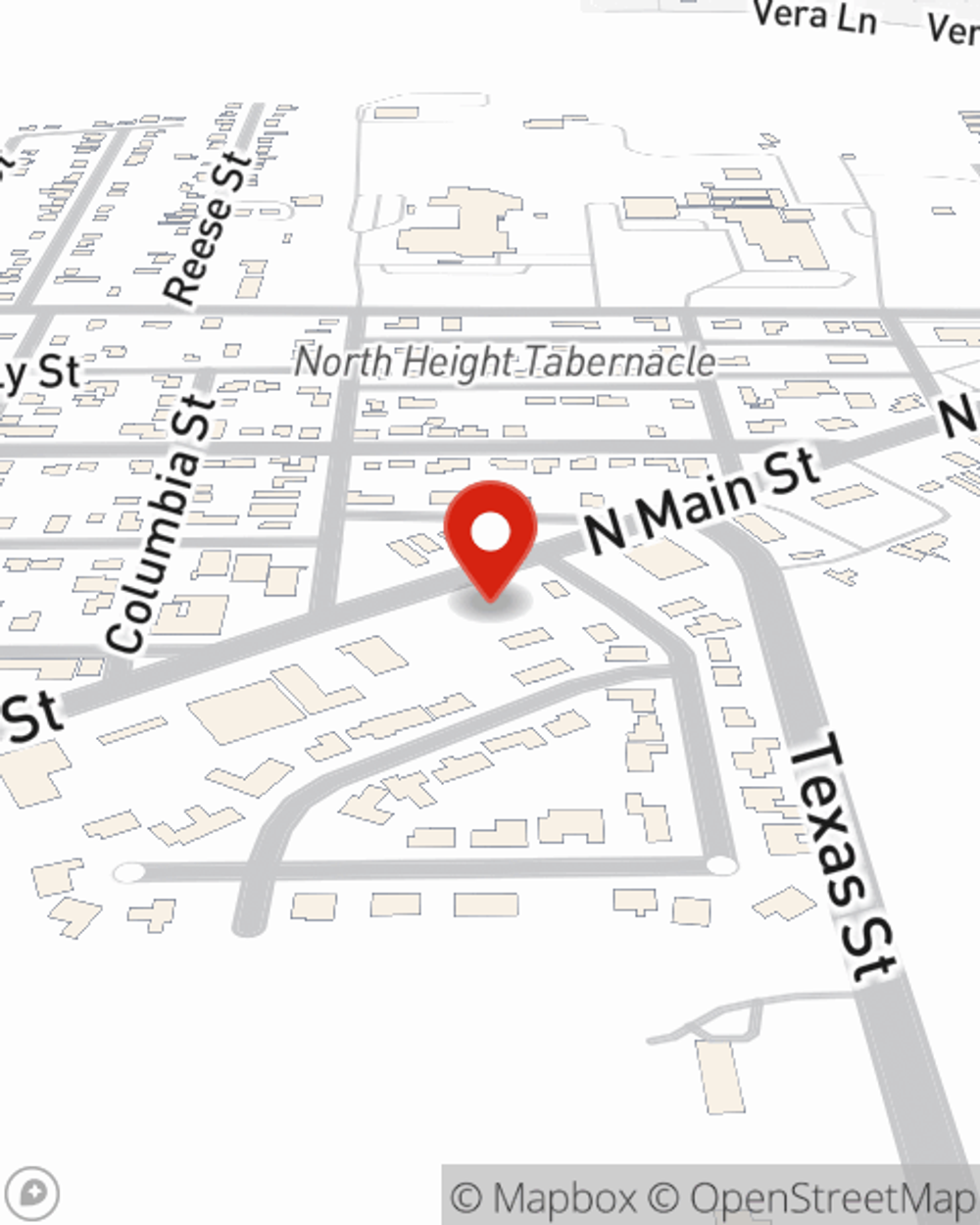

You have plenty of options when it comes to choosing a condominium unitowners insurance provider in Liberty. Sorting through deductibles and savings options isn’t easy. But if you want budget friendly condo unitowners insurance, choose State Farm for covering your condo and personal belongings. Your friends and neighbors in Liberty enjoy remarkable value and straightforward service by working with State Farm Agent Tracy Williams. That’s because Tracy Williams can walk you through the whole insurance process, step by step, to help ensure you have coverage for your condo as well as pictures, mementos, sports equipment, linens, and more!

Unlock great condo insurance in Liberty

Cover your home, wisely

Condo Unitowners Insurance You Can Count On

It's no secret that life is full of surprises, which is all the more reason to be prepared for the unexpected with condo unitowners insurance. This can include instances of liability or covered damage to your unit from vandalism, a windstorm or a tornado.

As a commited provider of condo unitowners insurance in Liberty, TX, State Farm aims to keep your home protected. Call State Farm agent Tracy Williams today and see how you can save.

Have More Questions About Condo Unitowners Insurance?

Call Tracy at (936) 336-2226 or visit our FAQ page.

Simple Insights®

Personal property and casualty insurance

Personal property and casualty insurance

What is Personal Property and Casualty Insurance? Learn more information on automobile, homeowners, watercraft, condo, renters and more.

Should you DIY your move or hire someone?

Should you DIY your move or hire someone?

Moves can vary in price — and effort. We walk you through your options, from DIY to full-service professional movers, and provide recommendations for when to opt for each.

Tracy Williams

State Farm® Insurance AgentSimple Insights®

Personal property and casualty insurance

Personal property and casualty insurance

What is Personal Property and Casualty Insurance? Learn more information on automobile, homeowners, watercraft, condo, renters and more.

Should you DIY your move or hire someone?

Should you DIY your move or hire someone?

Moves can vary in price — and effort. We walk you through your options, from DIY to full-service professional movers, and provide recommendations for when to opt for each.